Learn how to create a mobile payment app from scratch. Explore market research, platform selection, requirements gathering, design, development, testing, deployment, and marketing strategies.

Are you interested in creating a mobile payment app? In this article, we will explore the steps and considerations involved in developing a highly functional and secure mobile payment application. Whether you are an entrepreneur looking to revolutionize the payment industry or a business owner aiming to enhance your customers’ convenience, understanding the process of creating a mobile payment app will provide you with valuable insights and guidance. So let’s delve into the world of mobile payments and discover the key elements required to bring your innovative app idea to life.

Market Research

Market research is a crucial step in creating a successful mobile payment app. By conducting market research, you can gain valuable insights into your target audience, competitors, and industry trends.

Identify target audience

Understanding your target audience is essential for developing a mobile payment app that meets their needs and preferences. Conduct surveys and interviews to gather information about their preferences, demographics, and pain points. By identifying their needs and expectations, you can create a user-centric app that resonates with your target audience.

Analyze competitors

Analyzing your competitors is essential to identify gaps in the market and to differentiate your app from others. Study the features and functionalities offered by other mobile payment apps and identify areas where you can provide a unique value proposition. By understanding what your competitors are doing well and where they are falling short, you can position your app strategically in the market.

Study industry trends

Staying up to date with industry trends is crucial for creating a mobile payment app that remains relevant and competitive. Research advancements in mobile payment technology, security measures, and user preferences. By incorporating the latest trends into your app, you can ensure that it meets the expectations of your target audience and stands out from the competition.

Choosing a Platform

Choosing the right platform for your mobile payment app is a critical decision that will impact its reach and usability.

Decide between iOS and Android

Deciding whether to develop your app for iOS or Android depends on various factors, including target audience demographics, market share, and development resources. Consider the preferences of your target audience and the market share of each platform. It’s also important to evaluate the development capabilities and resources available for each platform.

Consider cross-platform development

Cross-platform development enables you to create a mobile payment app that can run on multiple platforms with a single codebase. This approach reduces development time and effort, but it may come with limitations in terms of performance and access to platform-specific features. Evaluate whether cross-platform development is suitable for your app based on your target audience, feature requirements, and development resources.

Gathering Requirements

Gathering requirements is a crucial step in shaping the features and functionalities of your mobile payment app.

Determine app features and functionality

Clearly define the features and functionality you want your mobile payment app to offer. Consider the core functionalities such as payment processing, transaction history, and account management. Additionally, think about additional features that can differentiate your app, such as loyalty programs or integration with other services. Prioritize features based on the needs and preferences of your target audience.

Define payment methods and security measures

Decide on the payment methods you want to support in your mobile payment app. Consider popular options like credit cards, digital wallets, and mobile payment systems. Additionally, determine the security measures you will implement to ensure the safety of user information and transactions. This may include encryption protocols, tokenization, and fraud detection systems.

Designing User Interface

The user interface is a critical aspect of a mobile payment app, as it directly impacts user experience and engagement.

Create wireframes and mockups

Start the design process by creating wireframes and mockups that outline the layout, structure, and flow of your app. Wireframes help visualize the app’s content and functionality, while mockups provide a more detailed representation of the app’s visual design. By creating these prototypes, you can iterate and gather feedback before moving to the development phase.

Focus on user-friendly design

Ensure that your mobile payment app has a user-friendly design that simplifies the payment process and enhances the overall user experience. Optimize the app’s navigation, use intuitive icons and buttons, and minimize the number of steps required to complete a transaction. Consider implementing features like autocomplete, contextual help, and error prevention to make the app more user-friendly.

Ensure accessibility and responsiveness

Accessibility is an important aspect of mobile app design. Ensure that your app is accessible to users with disabilities by implementing features like voiceover support, resizable text, and color contrast options. Additionally, design your app to be responsive to different screen sizes and orientations, ensuring a consistent and optimal user experience across devices.

Backend Development

Backend development involves building the server-side infrastructure and integrating payment gateway APIs.

Select a programming language and framework

Choose a programming language and framework that best suit your app’s requirements and development team’s expertise. Popular options for backend development include Python, Java, and Node.js. Consider factors such as performance, scalability, community support, and integration capabilities when making this decision.

Build server-side infrastructure

Develop the server-side infrastructure that handles user authentication, transaction processing, and data storage. Implement secure APIs that communicate with the frontend and payment gateway APIs. Ensure that your infrastructure is scalable, reliable, and optimized for high performance to handle a large number of concurrent users and transactions.

Integrate payment gateway APIs

Integrate payment gateway APIs to enable secure and seamless payment processing in your mobile payment app. Work with trusted payment gateway providers that offer robust security measures, support multiple payment methods, and provide developer-friendly APIs. Test the integration thoroughly to ensure that transactions are processed accurately and securely.

Frontend Development

Frontend development focuses on creating user interfaces for different screens and implementing user authentication and authorization.

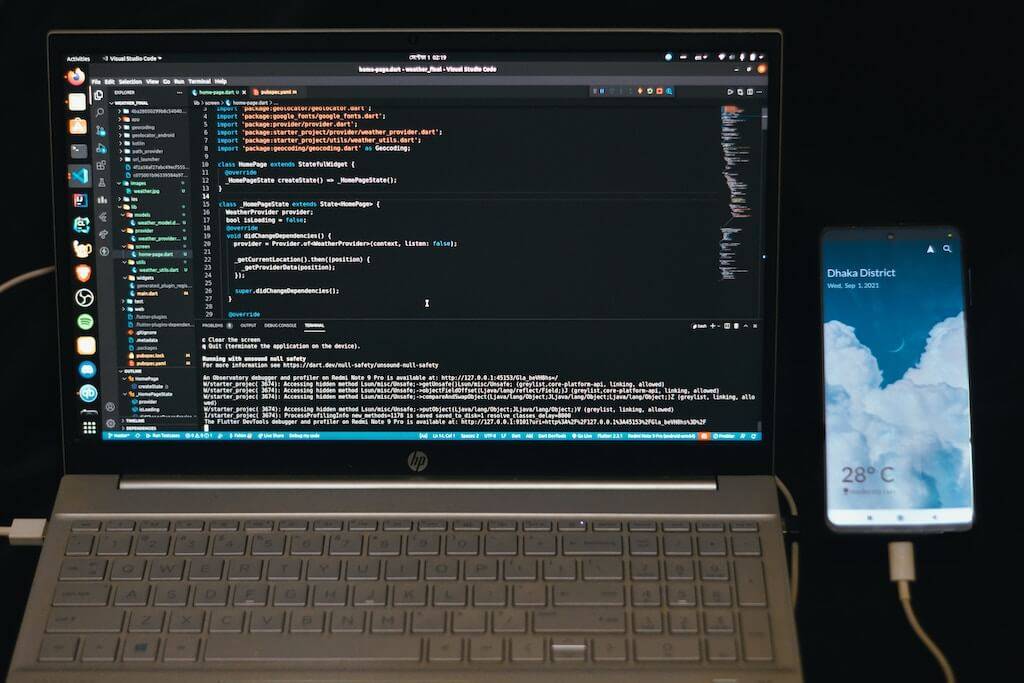

Choose a mobile app development framework

Select a mobile app development framework that enables efficient development of user interfaces across different platforms. Popular frameworks like React Native, Flutter, and Xamarin allow you to build mobile apps using a single codebase. Consider factors such as performance, community support, and availability of developer resources when choosing a framework.

Develop user interfaces for different screens

Design and implement user-friendly interfaces for different screens, taking into account the requirements of both iOS and Android platforms. Ensure that the interfaces are visually appealing, intuitive, and consistent across devices. Optimize the app’s performance by minimizing resource usage and implementing efficient data loading and caching mechanisms.

Implement user authentication and authorization mechanisms to ensure the security of user accounts and transactions. Utilize industry-standard authentication methods, such as OAuth or token-based authentication, to validate user credentials. Implement authorization mechanisms to control access to app features and ensure that sensitive information is protected.

Testing and Quality Assurance

Thorough testing and quality assurance are essential to ensure that your mobile payment app functions correctly and meets user expectations.

Perform functional testing

Test all the app’s features and functionalities to ensure they work as intended. Perform tests for each use case, including payment processing, transaction history, and account management. Verify that the app handles errors gracefully and user input validation is in place. Test on both iOS and Android devices to ensure platform compatibility.

Conduct user acceptance testing

Engage real users to conduct user acceptance testing. Gather feedback on the app’s usability, performance, and overall user experience. Use their input to fine-tune the app’s design and functionality. Address any identified issues or concerns to ensure that the app meets their expectations and provides a seamless payment experience.

Ensure security and performance

Perform thorough security testing to identify and address any vulnerabilities or weaknesses in the app’s security measures. Regularly update and patch any known security vulnerabilities to protect user data and transactions. Additionally, test the app’s performance under different load conditions to ensure that it can handle peak usage without any performance degradation.

Deployment and Distribution

Preparing your mobile payment app for submission to app stores involves following guidelines and optimizing the app store listing.

Prepare app for submission to app stores

Ensure that your app meets the requirements and guidelines set by the respective app stores. This includes providing accurate and complete metadata, complying with design and content guidelines, and addressing any potential issues or violations.

Follow guidelines and rules

Adhere to the guidelines and rules set by the app stores to ensure a smooth submission process. Make sure that your app’s design, content, and functionality align with their requirements. Address any issues or violations flagged by the app store review process promptly.

Optimize app store listing

Optimize your app store listing to increase visibility and downloads. Use relevant keywords in the app’s title, description, and tags to improve searchability. Create engaging and visually appealing screenshots and videos that showcase the app’s key features. Encourage reviews and ratings from satisfied users to build credibility and attract new users.

Marketing and Promotion

Creating a marketing strategy and leveraging various channels can help increase awareness and adoption of your mobile payment app.

Create a marketing strategy

Develop a comprehensive marketing strategy that encompasses various channels and tactics. Identify your target audience and tailor your messaging and promotional activities to resonate with them. Utilize a mix of online and offline marketing channels, such as social media, email marketing, content marketing, and events, to reach and engage your target audience.

Social media platforms offer a powerful way to connect with your target audience and promote your mobile payment app. Create engaging content, run targeted ads, and leverage influencer partnerships to increase brand awareness and generate user interest. Engage with your audience by responding to comments, queries, and feedback promptly.

Implement app store optimization

App store optimization (ASO) is the process of optimizing your app’s visibility and conversion within the app stores. Conduct keyword research to identify relevant and high-traffic keywords to include in your app’s metadata. Optimize your app’s title, description, and screenshots to attract users and encourage downloads. Monitor and analyze the impact of ASO efforts to continuously optimize app store performance.

User Feedback and Updates

Monitoring user feedback, analyzing app usage data, and releasing updates and feature enhancements contribute to the long-term success of your mobile payment app.

Monitor user feedback and reviews

Regularly monitor user feedback and reviews to gain insights into user satisfaction, pain points, and suggestions for improvement. Leverage user feedback to identify areas for enhancement or bug fixes. Promptly address user concerns and provide timely support to maintain a positive user experience and reinforce user trust.

Analyze app usage data

Collect and analyze app usage data to gain insights into user behavior, engagement, and conversion rates. Identify usage patterns, popular features, and potential bottlenecks. Utilize analytics tools to track key metrics such as user retention, user churn, and average transaction value. Use these insights to optimize the app’s performance, identify opportunities for growth, and inform future updates and enhancements.

Release updates and feature enhancements

Continuously release updates and feature enhancements based on user feedback, usage data, and industry trends. Prioritize and plan updates that address critical issues or introduce highly requested features. Regularly communicate with users about updates, highlighting the benefits and improvements. Proactively listen to user suggestions and incorporate valuable ideas into your app roadmap.

In conclusion, creating a mobile payment app requires a comprehensive approach that spans market research, choosing the right platform, gathering requirements, designing a user-friendly interface, developing the backend and frontend, testing and quality assurance, deploying and distributing, marketing and promotion, and iterating based on user feedback and analytics data. By following these steps and considering the unique needs and preferences of your target audience, you can develop a successful mobile payment app that provides a seamless and secure payment experience.

You can learn more on cybersecurity in our french website:

Explorez les meilleurs frameworks pour applications web et mobile

5 raisons pour lesquels votre entreprise doit avoir une application mobile dédiée au commerce électronique

Le Métier de Développeur Web Mobile dans les écoles d’ingénieurs

Le Métier de Développeur Web Mobile dans les écoles d’ingénieurs

Les avantages de Cordova pour développer des applications mobiles

Stratégie marketing pour votre application mobile

Les étapes pour apprendre le développement mobile

Comment devenir développeur d’applications mobiles ?

Comment tirer parti des Big Data pour améliorer l’expérience utilisateur sur votre site web et application mobile

Protéger une application mobile

Développer une application mobile pour Android

Méthodes de test pour applications mobiles

Utilisez React Native pour créer vos applications mobiles

Guide pratique pour comprendre le développement d’applications mobiles d’entreprise

Développement Web & Mobile : un secteur en croissance

Les métiers IT les mieux payés en 2023